Exciting Account Enhancements

Simple Accounts. Powerful Connections

We are excited to introduce a simplified line of checking and savings accounts that are designed to better reflect how you bank, save, and grow. This line up of enhanced products will be available July 1st.

Compare Checking Accounts

Clear

Banking that keeps life simple, so you can focus on what matters most.

- $25 Minimum to Open

- No Monthly Service Fee

- No Minimum Balance Fee

Connect

Spend with purpose, earn rewards, and give back to a greener community

- $100 Minimum to Open

- $10 Monthly Service Fee

- No Minimum Balance Fee

- Earn $0.05 for each Unity Bank Debit Card Purchase

Ultimate

Rewarding your hard work with higher interest on the balance you keep.

- $500 Minimum to Open

- $10 Minimum Balance Fee

- $500 Minimum Balance

- Interest Bearing

Debit Cards

Manage Your Money with Ease

At Unity Bank, our Debit Cards offer a convenient and secure way to access your funds and make purchases. Whether you're shopping in-store, online, or need to access cash, our Debit Cards provide flexibility and control.

You also have access to a large surcharge free ATM network with MoneyPass!

Choose Your Own Card Design

Your card, your style! Choose from the variety of card designs below to make your card uniquely yours.

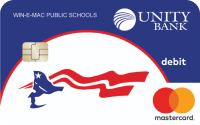

School Spirit Debit Cards

Show your support for our local schools with Unity Bank’s School Spirit Debit Cards! For every purchase you make with your School Spirit Debit Card, we’ll donate $0.05 to your local school district. It’s a simple way to contribute to the community and foster school spirit, all while enjoying the convenience and security of your debit card. Join us in making a positive impact on our schools with every transaction you make.

Features & Benefits

Secure Transactions:

With advanced security features, including EMV chip technology, your transactions are protected against fraud.

Convenient Access

Use your Debit Card for everyday purchases, both in-store and online, or withdraw cash from ATMs nationwide.

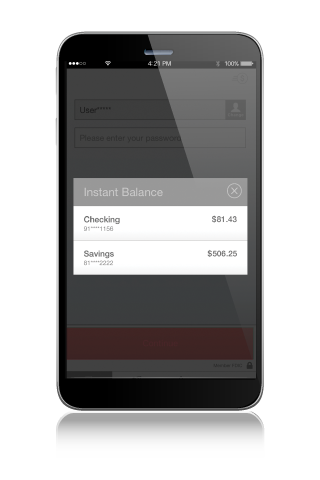

Instant Balance Updates:

When it comes to managing money for tuition, books or back-to-school shopping, feeling empowered is key. Instant Balance puts you in control. Quickly and easily check up to six account balances at the touch of a button, all without logging in. You can feel financially confident to view account balances and transfer money in an instant.

Travel Notifications:

Set up travel alerts to ensure your card works smoothly when you're away from home.

Manage Your Card

How to Activate Your Debit Card

By Phone:

You will need to call Card Self Service at 866-661-8548 and use the convenient automated system to activate your card. (activation must be completed within 90 days of the date was issued)

- Enter card number as it appears on your card, followed by #

- Enter 3-digit security code on the back of your card

- Enter Primary cardholder’s 5-digit zip code

- Enter 4 last digits of primary cardholder’s social security number

- Enter primary cardholder’s 10-digit phone number

Lost or Stolen Card

If your card is lost or stolen, act quickly to protect your account:

Lock Your Card:

Use the mobile app to lock your card immediately.

Report Lost/Stolen:

Call 800-472-3272 after hours or 877-889-6847 during business hours to report a lost or stolen card.

Order a New Card

Need a replacement or additional card? Contact us to request a new Debit Card.

Card Control

Our card management experience offers you more control of your cards than ever before, right from our Mobile Banking app.

Greater Card Protection

Our card controls offer more protection than ever, allowing you to lock and unlock your cards and limit transactions by location, merchant, and transaction type. You can report lost or stolen cards from the app and set up alerts to stay informed about how your card is used.

Enhanced Insights

Our handy list of subscriptions and who has your card on file gives you a clear picture of where your money is going. Easy to read graphs make understanding your spending habits simple, and details such as merchant names, logos, and contact information give you greater insight into your card transactions.

Ultimate Convenience

Easily set travel plans to ensure your card is not declined, and even access your new card before receiving it in the mail. Plus, self-service options give you 24/7 assistance without calling a service number.

Get Started

If you are new to Mobile Banking, simply download our Mobile Banking app today!