QuickBooks Notice: We are aware that some customers are experiencing an issue connecting their QuickBooks software with Business Online Banking after a recent QuickBooks update. Please try reconnecting your account by following these instructions. If you are still unable to connect, please reach out to your QuickBooks support.

Cash Management Team

Important Online Banking Cutoff Times

Same Day ACH Payments: 2:00pm CST

Next Day ACH Payments: 5:00pm CST

Outgoing Wire: 2:00pm CST

Same Day Mobile Remote Deposit: 5:00pm CST

Same Day Remote Deposit: 5:00pm CST

Business Online Banking

Simplify your financial management with our Business Online Banking solutions. Designed to meet the needs of modern businesses, our platform offers secure, 24/7 access to your accounts, streamlined transactions, and powerful tools to manage your finances efficiently.

- View current account balances and recent transactions

- Transfer funds between Unity Bank Accounts

- Make Unity Bank loan payments

- View statements and notices for the past 18 months

- Authorize key employees to access the business accounts

Business Online Login with Password Help Guide

Business Online Login with Soft Token Help Guide

Business Online Login with Physical Token Help Guide

Online Banking Security Tokens

Unity Bank strives to deliver the highest level of protection for our Business Online Banking customers. That’s why you can use a soft token or a physical token that will generate a secure one-time password to use each time you log in to your account.

Soft tokens are generated from an app on your smartphone. Physical tokens are small hardware devices that you carry with you.

Rather than using a traditional password that can be stolen or hacked, the tokens generate a random, one-time string of numbers that you enter when logging into your account. The number is combined with a PIN that you create when setting up the token as an extra layer of protection to complete transactions such as wires or ACH.

ACH Origination

In today’s fast-paced business world, electronic payments are essential. With ACH (Automated Clearing House), you can easily transfer funds to or from your account without hassle.

Create ACH files quickly using our user-friendly software. Just enter the recipient’s account number, routing number, and account type, and let Unity Bank take care of the rest.

- Boost Your Revenue: Seamlessly process electronic transfers to enhance your business income.

- Reduce Admin Work: Cut down on the time and effort needed to handle payments manually.

- Enjoy Greater Convenience: Make payments and collections easier for you, your team, and your vendors.

- Lower Fraud Risk: Minimize the risk of check fraud with secure electronic transactions.

ACH Cutoff Times

Next Day ACH: 5:00pm CST

Same Day ACH: Multiple Times Throughout the Day

Common Uses

- Direct Deposit of Payroll

- Expense Payments

- Preauthorized Debits

- Business-to-Business Transactions

- Invoice Payments (Sending & Receiving)

ACH Origination User Guide

Merchant Services

Experience Seamless Processing of Debit and Credit Card Payments with COCARD.

Thanks to our partnership with COCARD, we offer secure top-tier electronic payment products and services tailored to your business needs. No matter your industry, we have the expertise and solutions to simplify your payment processing.

COCARD provides an all-in-one package with hardware, software, customized apps, and a merchant account. Easily handle payments, manage inventory, track sales, oversee employees, and integrate custom apps. Whether you're in retail or the restaurant industry, COCARD has the right solution for you.

Features

- Flexible Payment Options: Choose from a variety of point-of-sale networks to fit your business needs.

- Online Access: Manage and view crucial merchant information anytime, anywhere.

- Complete Equipment and Software: Access a full range of payment equipment and software solutions.

- 24/7 Support: Get round-the-clock help from our dedicated merchant helpdesk.

Business Mobile Remote Deposit Capture

Streamline Deposits with Mobile Remote Deposit Capture (mRDC)

Enhance your business’s cash flow and manage daily operations more effectively with our Mobile Remote Deposit Capture (mRDC) app. Depositing checks is easy and secure, right from your mobile device.

Deposit Cutoff Time

5:00pm CST

Secure Deposits

Authorized key employees to use the mRDC app to process check deposits securely. Simply log in with your credentials, select the deposit account, and take a photo of the check.

Deposit Anytime, Anywhere

Make secure deposits from your mobile device, no matter where you are.

Save Time

Reduce trips to the bank and manage your deposits more efficiently.

Track Deposits Easily

Keep an eye on your deposits with ease through Online Banking.

Protect

check deposits by securely processing them as you receive them

Save

time and money with fewer trips to the bank

Deposit

checks quickly and easily from a smartphone or mobile device

Improve

cash flow by processing deposits faster

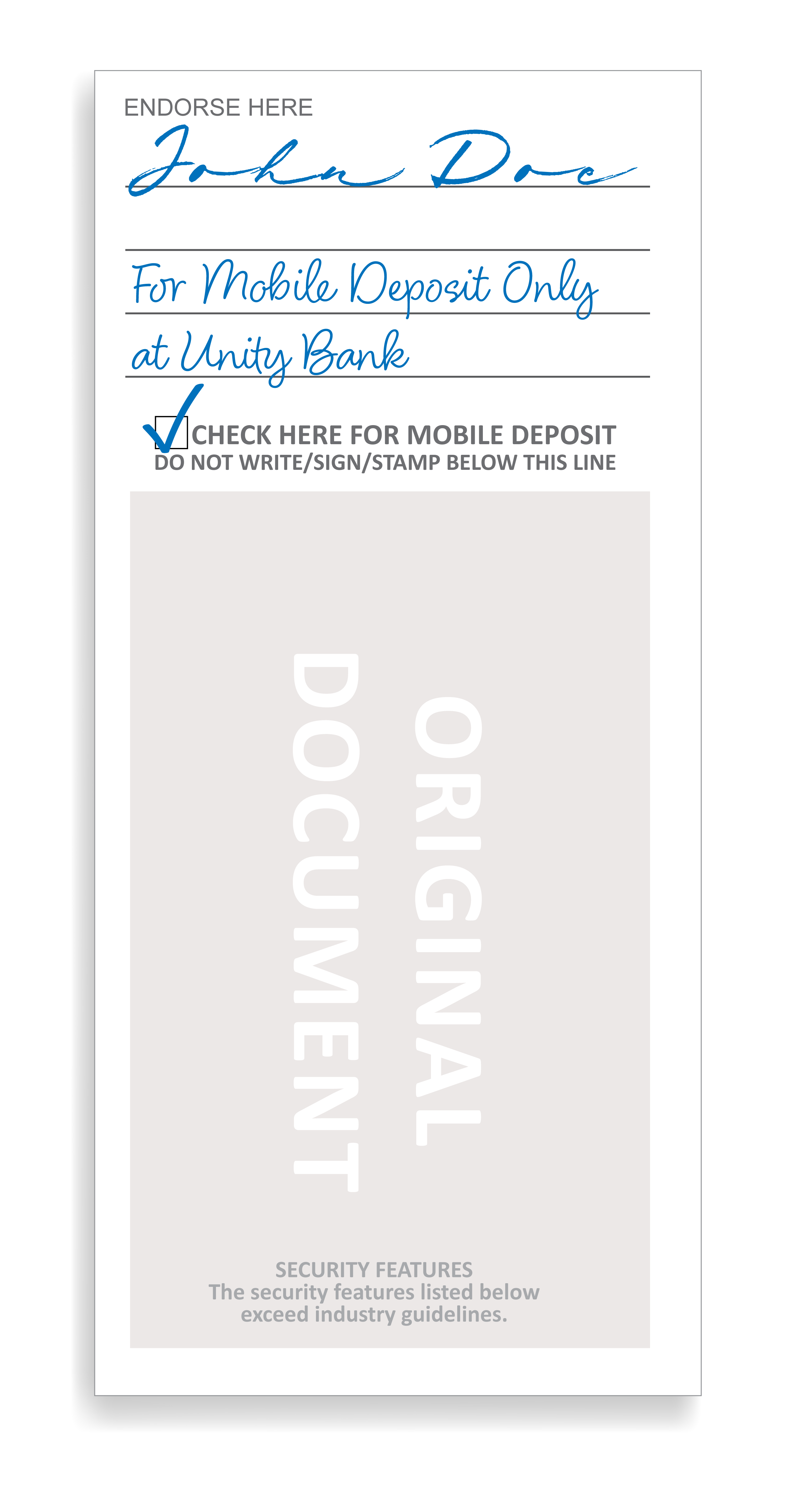

Properly endorsed check

A properly endorsed check includes the payee’s signature along with a restrictive endorsement, such as “For Mobile Deposit Only at Unity Bank.”

Remote Deposit Capture

Cut down on bank trips and manage your cash flow more efficiently with Remote Deposit Capture. Deposit your checks right from your office, making your daily operations smoother and more effective.

Enjoy the convenience of managing your deposits remotely with Unity Bank.

Remote Deposit Cutoff Time

5:00pm CST

Easy Deposits

Process non-cash deposits securely from your office when it's convenient for you.

Reporting

Get tailored reports to help with reconciliation.

Deposit Alerts

Receive email notifications confirming your deposits.

Schedule Wires Online

Keep your money moving quickly and securely with Online Wire Scheduling. Send funds anywhere in the world with ease through Business Online Banking.

Outgoing Wires Cutoff Time

2:00pm CST

Easy Scheduling

Request wire instructions from the recipient, enter the details into Wire Manager, and schedule your wire transfer at any time.

Same-Day Transfers

Wires submitted before the cutoff time are sent the same day; otherwise, they’ll be processed the next business day.

Better Control

Manage outgoing wires to streamline your payables process and enjoy the ease of sending wire payments from anywhere.

Less Admin Work

Reduce the hassle of processing check payments. Ability to save wire instructions for wires that are sent frequently.